A CPA's review, comparison and recommendation of Xero, Saasu, MYOB AccounrtRightand QuickBooks Online. Pros and cons of moving to cloud-based accounting. How it fits with cloud-based inventory management.

Quick pros and cons of cloud-based accounting

Moving to cloud accounting may not be right for your business. The pros and cons roughly speaking look like this:

- Con: You will lose core functionality if you come from a 'big' ERP like Dynamics or Sage ERP (but are you using this functionality?)

- Con: Data security risks change: some risks are much lower, but there are new risks

- Con: If you cancel your subscription, you need to export and import your data somewhere else

- Pro: Cloud software is easier to use; more people will use it properly, new employees get up to speed faster

- Pro: Cloud software is easier to own: no server, no updates

- Pro: Cloud software is where all the important SME innovation in tech is happening. It's mobile, it's global, it's cheap

Only the first point is a clear step backwards.The cloud accounting packages offer almost no ERP/Inventory Management features. Instead, they offer integrations to cloud ERPs. This means you will see big gaps between a legacy ERP and, say, Xero, but when you factor in a cloud ERP, the gaps diminish. That is not really the topic of this article. If you want more coverage of cloud inventory management (ERP for small and medium businesses, see this detailed review of Unleashed, Dear Inventory, Cin-7 and how they work with Xero

Signs that you are ready for cloud-based accounting

- You have outgrown an entry level accounting package due to transaction volume, customer requirements or scale

- You need smooth integration with multiple sales channels, such as B2B, online, retail

- You face an expensive server upgrade or an expensive software upgrade to a new version

- You have a workforce which has become mobile and spread-out, or you want to use overseas workers.

- You want to access new tools like CRMs, analytics

Because pure cloud apps are easy to integrate, cloud products can narrow the scope of what they do, and concentrate on doing it well. The leading cloud products focus on bookkeeping, bank recs, core financials and payroll. The modern cloud-based accounting packages no longer try to be Jack of all trades.

Key Functionality Comparison: Xero, MYOB, QuickBooks

What you get before you look at integrating with third party packages

Unlike traditional software, cloud packages are designed to be plugged together. The accounting vendors may seem to be ignoring your requirements, but instead they have probably decided that it is a better outcome for everyone if you integrate with a third party that has a really good solution.

I will now summarise what you get, in a simple table. To represent the traditional world of mid-tier ERPs, I choose Sage ERP (branded as Accpac for many years), a very traditional system (which I quite like).

I have not listed MYOB AccountRight here, as I do not recommend it. I have removed Saasu, as Saasu is withdrawing its more advanced plans.

| Module | MYOB Essentials (was LiveAccounts) | Xero | QuickBooks Online | Cloud Accounting + Cloud ERP | Comparison with Typical traditional ERP (Sage ERP) |

| Sales | Very minimal. |

Minimal, but improving. Quotes are now possible. Pricing and credit terms are very minimal. Third party options are very strong. |

OK, similar to Xero & Saasu. | Very good, meets nearly all requirements | Very sophisticated. Backorders, partial payments, complex payment terms. Returns, under payments and over payments are well handled. The interface is dated and the system is batch based, meaning careful attention to routine processing is required. |

| Purchasing | No | Basic. Receipt & invoicing is the same step. | Basic. | Very good. Auto reordering, multiple receipts, accrual accounting. Only basic approval flows though. | Strong but bureaucratic |

| GST | Excellent | Excellent | Excellent | Handed to accounting backend. GST On Imports support is good. | Poorly localised. |

| Payroll (Australia) | OK for small payrolls |

Very good. Xero's subscription includes web-based employee self-help and apps for easy phone-based expense claim submissions (snap a receipt). Xero is pushing ahead in this area, and has increasingly strong differentiation (plus good third party modules for more complex situations). Xero will not support more than 200 active payroll users. In this case, can use KeyPay for instance.

|

No payroll, but close integration with 3rd party provider KeyPay. It becomes much more expensive the Xero, at $4 per user above 10 users. | N/A | No Australian localisation. Requires third party modules at $4 to $6 per head per month, typically. |

| Fixed Asset Ledger | No | Good, a genuine fixed asset ledger. Can keep separate Management and Tax books. Multiple deprecation options. Automatically recognises gain/loss on disposal. Compliant with Australian/NZ standards (asset pools etc). Can do bulk imports of data. You can enter basic warranty and serial number information per asset. |

No fixed asset ledger built in (3rd party integrations are available) | Some ERPs have fixed asset support, but you will really want to leave this to the accounting system if you can | Very good support for fixed assets in all legacy ERP products. |

| Perpetual Inventory (i.e. "real" inventory) | No | Yes, as of March 2015 . As of October 2015, the API fully supports 'tracked inventory', as Xero calls it. Single location. No batch or serial. | In the top-tier, there is basic Perpetual Inventory. Saasu's is better. | Very good. Batch, expiry dates, serial numbers enhance it. FIFO is the main costing method. | Outstanding. Multiple sites, multiple stock-take procedures, multiple valuation methods. |

| Job costing | basic. Accountants are supported by MYOB's practice management software | 3rd party solutions, including Workflow Max, bought by Xero. Accountants are supported by Xero's practice management version. Using tracking categories to do this is unsatisfactory. Xero has has a Project Module (small additional charge) which links multiple invoices and expenses to a single project. It's quite nice for a simple solution, we are using it at GrowthPath. |

limited. Like Xero, you can track expenses to be billed to clients as recovery (you can assign a default mark-up too) | Basic at best. | optional modules. |

| Intercompany (auto-balancing entries) | No | No | No | No | optional modules (very good) |

| Segmenting the business | No | Yes (tracking categories, two dimensions, like having acct + two segments). 'New' reporting module allows consolidation of a subset of tracking categories. | Yes (classes). Similar to Xero. | Supports Xero tracking categories, some better than others. | Yes, via account structure. Very good. |

| Budgeting | Budgets per account. Can upload from spreadsheet, but no breakdown features. Multiple bugdets. Budgets by tracking category. | Can budget by 'class' (segment) and/or by customer. | Cin7 offers some budget features, others not. | ||

| Securing Access to functions, period locking | OK | Good: 'advisor' user can continue entry in a date period locked to ordinary users (e.g. for month end processing) | To be assessed | Yes | Very strong controls over functionality. Locking is sophisticated: submodules like AR can be locked while still allowing GL postings. |

| Cashflow management | OK | OK. Can indicate likely payment dates for POs and AR, to help with reporting. | To be assessed | Dear provides some assistance to Xero. | OK. Lots of potential insight, but hard to use. |

| Analytics and Dashboard | Not really | Basic. But it has the best report writing tool, even though that just lets you customise traditional accounting reports. Integration with 3rd party. | To be assessed | Reporting is quite good. | No (comes with a one-user Excel tool) |

| Audit trail | Not enterprise class. | Not enterprise class, but deleted transactions are mostly viewable. The audit trail features have been improving, and they are now good to very good. | Good | Good to very good. | Very good. |

| Two-factor login | Yes | Yes | Yes | Varies | Login security is controlled by Windows login, usually |

| Single Sign On | No | Google (https://central.xero.com/s/article/Access-Xero-through-G-Suite) | Varies | No | |

| Multi-currency | No | Optional. Pretty good. Automatic management of unrealised and realised gain loss. Automatic exrates, can also use book rates. No integrated support for hedging contracts. | Same as Xero | Very good | Very strong. |

| Third-party integration |

Example: Kounta POS: Yes (Native). Unleashed sales and inventory: No DIY: Easy.

|

Example: Kounta POS: Yes (Native). Unleashed sales and inventory: Yes (Native) DIY: Easy Shopify: yes |

Very good, roughly equal to Xero. |

Varies |

Effectively none. DIY: Possible. Talent is rare (although GrowthPath has expertise). Requires use of old technologies, so expensive. |

| online payment integration | To be assessed | Yes | Yes | Yes | No. Needs custom coding. |

| API & integration |

API is satisfactory, after years of no API. Not much out-of-the box support, but possibly growing. |

Outstanding, best in class and with momentum. Every cloud package offered to the Australian market will offer Xero integration, and the API makes it cheap to build your own integration. |

Very good API. 'Out of the box' integrations are very good, close to Xero. |

Varies. |

Possible via use of Win32 COM (GrowthPath is experienced in using Python to drive Accpac ERP and we have interfaced Accpac to Shopify, Infusionsoft and Pracsoft). But it is much more cumbersome than Web APIs. Third party integration is poor. The vendor has online , CRM and business analytics packages which are classic examples of the "jack of all trades" problem: they are ok. Raw data is stored in SQL, which is easy to access and for reporting, an alternative to using an API. |

| Implementation and ownership costs | Somewhere between 3 and 10 times cheaper than a traditional solution | Somewhere between 3 and 10 times cheaper than a traditional solution | Somewhere between 3 and 10 times cheaper than a traditional solution | Varies, but per-user fees, much more expensive than cloud accounting. | Expensive to buy. Expensive to implement. Expensive to keep. Productivity payoffs in high-volume manual data entry. |

| High volume manual data entry | Not really expected | Some optimisation has been made, but browsers are not ideal for this. High volume data entry should be done via the API (or CSV) | Same as Xero; but CSV imports are more limited | Varies but not as good as legacy desktop software | Outstanding. This software comes from the era of manual data processing. |

| User training requirements (e.g. new staff) (assuming the user has basics GST and double-entry bookkeeping) | Very minimal | Very minimal, although non-standard events like customer overpayments are not obvious. There are plenty of YouTube videos and help documents. There are many certified book-keepers | Same as Xero | This is more complex and training is required | You need formal training because the software is complicated and mistakes are hard to correct. |

| Transaction limits (sales) [these are rough estimates, not official vendor numbers, and this is an uncertain science] | Unknown | Stress testing indicates that it performs well above claimed limits. See here for test results | Similar to Xero | High limits | Very high (50 x Xero to ballpark it) |

| User support | Good online chat support | I used to rate Xero as having the worst support. However, things have changed for the better. Firstly, there is now live chat. Secondly, the community documentation is the best by far. Thirdly, the "Xero University" training portal is outstanding. And finally, Xero has the most users and it's easier to find bookkeepers who know how to use it. So I give Xero a pass on support now. | The support winner: fast access to a helpdesk supported by screen sharing which is extremely effective. | Varies. | Contact reseller at $1500 per day. |

| Recruitment for specific package skills | Rare | Easy in Aus/NZ, not too bad elsewhere. | possible | possible, but expect to train | possible but not common, steep learning curve. |

Pricing and Plans

Since Xero has won the cloud accounting market in Australia, it has dropped out of fighting with low prices. MYOB, Saasu and QuickBooks still have cheap pricing for reduced functionality. For Xero, the dominant driver of pricing is how many active payroll employees your process; monthly costs are in the range of $60 to $90 for most GrowthPath Xero clients. In June 2019 (approx) Xero will release its first cheaper product in about ten years: a new payroll-only plan for businesses with a handful of employees.

Xero does not charge per user. The biggest impact on your cost is the number of people on payroll.

Quickbooks Online has a broader range of plans: the lowest plans are cheaper than Xero but are not functionally equivalent. Payroll can get much more expensive.

Myob AccountRight: Pricing is similar to Xero.

Xero

The now-dominant cloud-based SME accounting offer at least in Australia/New Zealand, is Xero. Xero is a genuine disruptor. Xero launched later than Saasu. With a crystal-clear understanding of their market and what a cloud-solution should offer, Xero looks like a winner. Its user growth continues to be extraordinary, and there is a lot of product development. Almost every third party product integrates first with Xero; it is the iOS of the cloud accounting market.

Xero is a good accounting package. Australian localisation is second to none. It has an excellent and well-tested API. It has promoted a good certification program to develop skills among bookkeepers, and there is a lot of community support. Functionality improvements are constant. Our clients are quite simple delighted with Xero, and it's my default recommendation.

The main competitor is QuickBooks Online (QBO). Xero differentiates from QBO by having a fixed asset ledger, a better API, better report writing and better CSV import features. in Australia/NZ, Xero additionally differentiates by having better payroll, better bank integrations and much higher market share.

In March 2015, Xero addressed one of its biggest problems, by finally adding inventory. But it's a basic stock module. For more sophisticated requirements, Xero defers to other cloud-players, which use Xero's API to integrate easily. This offers some surprisingly powerful cloud ERP/supply chain solutions. There are cloud providers who offer inventory management solutions approaching the capabilities of respectable ERPs with licence fees above $50K. These packages provide multi-site inventory management, purchase orders and sophisticated sales order systems. And of course, integration with online stores like Shopify is supported "out of the box".

Note that QuickBooks Online also has integration with some advanced supply chain cloud packages, but Xero's integration choice is a bit wider (although there is no longer . There are some notes here about integration, but please contact GrowthPath for more information.

Regarding core accounting functionality, Xero has emerged as the best of the packages here. There are still some gaps compared with the old MYOB desktop product, but there are gains as well (Fixed Assets, much better bank feeds, much better payroll, auto-reversing journals, segments).

With Xero, extending capabilities is easier than any of the competition, and the rate of development is the fastest, although that is a subjective comment. No package has a better API, and Xero also has the largest developer mind-share.

I think most medium-sized businesses will find Xero's payroll, basic reporting and GST functionality fine. Like QuickBooks, AccountRight and Saasu, Xero requires that you understand bookkeeping. MYOB Essentials reduces functionality and makes interface choices to be more accessible for one-person businesses. For bookkeepers, here's a shout-out to Xero: it supports auto-reversing journals, which is a nice touch, greatly appreciated by people using accruals to get good profit figures per month. MYOB and Saasu don't do this; some versions of QuickBooks do but not the cloud versions.

Xero offers tracking categories to support segmenting your business. This is a great feature. Tracking categories are what more traditional systems call sub-accounts. It means that you can have up to three dimensions of reporting in the chart of accounts (e.g. a P&L or Balance Sheet by profit centre and cost centre). This becomes very useful when a module such as a supply chain system maps to it. Dear and TradeGecko do this.

Xero shines as part of a cloud-based workflow. Here it is well ahead of its competition. Export of reports into Google Drive is native, for example. Images and notes can be attached to most records. Saasu is making some recent strides in this direction, and its use of tags is becoming sophisticated.

Xero support if you run into difficulties is unfortunately basic. Xero expects that you get support from your bookkeeper or accountant. The amount of online help is copious, at least. In practice, GrowthPath clients become self-sufficient in Xero very quickly.

Xero's transaction limits: This is a confusing picture, partly because the internet never forgets. Xero has been around for a while, and the business was unwilling to overcommit, leading to the infamous "1000 transactions a month" rule, a statement which is at least five years old. In the meantime, Xero's backend resources have increased enormously. However, the problem we have is that Xero will not commit to anything above this old limit, and there is no good way to size in advance. Transactions are not very well defined: is it a bank statement line, an invoice line, an invoice ....? Xero is vague. A bit like Captain Barbosa, these are now "guidelines" rather than actual rules, and Xero support invites users experiencing problems to get in touch with support. It is clear from forum discussions that performance degrades at some point, and this point is easily reached if Xero is treated as a retail POS, which can generate many customers and many invoices. For medium sized businesses, treat Xero as a back end and take only consolidated figures. In fact, if you use a cloud POS like Kounta, this is what happens in the integration to Xero. If the integration you use doesn't do it, an option may be to consolidate transactions after they arrive in Xero.

However, consolidation is not a good option for open documents (unpaid invoices), so consolidation is an option for retail, but not for complex wholesalers.

To try to bring some certainty to this (and comfort for our clients), GrowthPath conducts stress testing. Some of GrowthPath's generic Xero stress test results are published here. In our testing, Xero performs better than you would expect if you were guided by the "1000 transactions" rule.

Xero is the "gold medallist" cloud accounting app. However, some things can get slow with large transactions, such as detailed GST reporting.

MYOB Essentials (formerly MYOB LiveAccounts)

MYOB Essentials is a reboot, the second generation of its pure cloud bookkeeping package. It keeps the simplicity of the former LiveAccounts but offers a good API. MYOB lost years, and it suffers by being late to the market. However, MYOB itself appears to be resourcing integration with some well-known cloud packages, and the use of a web-based API means that building your own integration is easy (or cheap).

- MYOB Essentials is well supported, with very helpful live support included in the subscription.

- It's a real double entry accounting system with real live feeds from bank accounts (but it doesn't have Perpetual Inventory).

- Given it's a real accounting system, it's not complex. It's fast to get started.

- MYOB Essentials has some big functional gaps. No inventory, no support for different credit terms or even rudimentary job costing. It now has payroll, at least.

- Reporting is basic. Almost no support for cash flow forecasting. Virtually no export to Excel.

- LiveAccounts looks quite close to MYOB. The default chart of accounts follows the same numbers. The BAS report looks like BAS Link.

While Essentials is a big improvement from MYOB LiveAccounts, MYOB clearly does not expect it to appeal to "larger businesses" (which it defines as > $3m). MYOB points people to a hybrid-web version of its traditional MYOB product, AccountRight, and from there it offers MYOB Exo, a traditional (and not very impressive) ERP package. MYOB is steadily adjusting to the new world; it remains to be seen what happens to its market share.

MYOB AccountRight (Previously AccountRight Live)

Desktop MYOB has officially lost its name. MYOB's success product was known as AccountRight Live during a long transition period, but it is now known simply as AccountRight, the legacy name.

Muchof MYOB's customer base is using AccountRight Premier, the traditional MYOB product. It is a technological dinosaur -- a slow, crash-prone non-server backend with a limit of three years of data and idiosyncratic user-interface which hasn't changed much. The new MYOB has a better-looking user interface look. The new system is not really cloud-based: you need a Windows-only program to use it, and frankly, the performance when running the data in the cloud is close to appalling. This is not indicative of cloud software in general, it is a feature of MYOB's engineering compromises. I refer to this as a "hybrid" product.

MYOB has two cloud solutions: MYOB Essentials, targeted at the low-end of the MYOB customer base, and the only hybrid product on the market, AccountRight (Live). Hybrid means it is possible to keep the data in the cloud, allowing easy remote access. The software normally used to access cloud software is a browser, but in the case of AccountRight (Live), it's a Windows-only package (even when using the data 'in the cloud'. So you still need Windows and all that entails. No OS X, Chromebook, Linux, iOS or Android access.

AccountRight (Live) is not exactly the same as the legacy version, despite the familiar name. The latest pricing options have higher-end plans which offer stock and payroll; the functionality may not be exactly the same as AccountRight Premier but it's close (on the more expensive plans).It finally has multi-currency. It's inventory module is weaker is not directly comparable. It doesn't support the ODBC driver, which is bad news for businesses which use add-on software for MYOB, but it has an API. Accessing AccountRight Live requires use of AccountRight installed on a Windows PC. It is has two modes of operation. In "cloud" mode, users are accessing a MYOB file on the cloud. No one can use local data in this mode.

Upgrading an existing MYOB data file to the new version is automatic and free, as long as your data file is accepted.

If you run it in cloud mode and someone wants to use it offline, the system goes into single user mode. Cloud access is now read-only. Apparently, this means that somewhat paradoxically, you need to have internet access to go offline (or how else does the cloud file know a user wants to checkout the file to go offline?). MYOB warns that cloud mode may be slow compared to the "fast" desktop version, and the desktop version is not fast to start with. Note that this also means you need to resume access to the internet to unlock the cloud file so that other people can update MYOB.

The API seems complete; it is a layer on top of the old product (it seems). Reports from people who havethe API indicate that it is around 100 times slower than they expected.

Please note that there is some support for integration of cloud apps with AccountRight Live ... but mostly this will only work when you are using the cloud data option (OneSaas, for example, has some integrations with AccountRight Live, but they only work when using cloud data mode). But the cloud option is slow. This is because when in local mode, cloud integrations would require you to install some fairly complex software on a server in your network ... and developers are unlikely to do this because it is expensive to support.

So at this stage, it is very hard to recommend MYOB AccountRight (Live). It is very hard to use in cloud mode, which means it has all the disadvantages of the legacy product, including the performance problems with more than a few users. It ties you into Windows, it has very little integration capability. It starts to look like a dead-end choice. However, it is an easy upgrade from legacy MYOB, most of the the time.

From the user's point of view, there is one benefit to compensate for the lack of a true cloud solution:

- access to data offline (but this locks all cloud users out), which can also be viewed as a very easy way to take your data with your when you end a subscription.

MYOB's other products

MYOB has a range of other products. For many years, its strategy to upsize businesses was to move them to new products, like MYOB EXO, a traditional ERP. I don't think it works very well, in general, I am not with Exo. MYOB has a new product for larger businesses, MYOB Advanced, which is a cloud ERP bundling the usual suspects (such as a CRM). I know little about it as this stage: It is a localised version of Accumatica, which looks like a very good product in the larger enterprise niche. Localisation was not complete as of mid 2015: last time I checked in, it was still missing bank feeds and Australian payroll. It is a serious, complex and expensive product, for businesses with more complex legal and business control requirements. It is also sold via a fairly traditional 'middle-man' sales channel, with expensive implementation services and expensive recurring charges; as such it weighted to the monolithic model where you buys lots of bundled functionality.

The contrast with the promise of Open API-based products is stark: with those, you grow by integrating functionality, not by changing platforms. This gives you the chance to choose the best CRM for your industry, for example. It is interesting that few vendors attempt to bundle online stores anymore: the stand-alone products quickly became overwhelmingly superior. This is true of other modules as well, in my opinion.

Saasu

Saasu never moved beyond a niche product, although not for any functional reasons. Saasu is moving out of the SME market, and focusing on micro-businesses. It is no longer covered by this review page.

Quickbooks Online

The licence model is based on the number of simultaneous users, which is better than its old per-user model but still worse then Xero or Saasu. There are three price plans, often heavily discounted for the first year. Quickbooks is a good-looking package and offers similar functionality to Xero and Saasu (It has a stock module, at least in QuickBooks' top pricing tier). The online version does a good job of importing data from a traditional Quickbooks application. It is fairly fast, but in general it is noticeably slower than Xero. It has a good set of reports. It looks very much like a desktop app ported to the web, but it's a decent browser interface, although at the time of writing in won't run in Chrome on my Mac. I have done some limited stress testing, including loading it with 12K SKUs; data entry hardly slowed down at all (using a good but not great internet connection).

I tested product support, and it was impressive. Via an offshore call centre, the tech support did a remote screen share into my Mac and helped me diagnose the problem. The problem indicated a lack of maturity in the product; payroll reports can't be run from the general reports section, which is confusing. However, the support was the most effective I have received from any of the cloud products.

Quickbooks Online does have inventory in the higher plans, but it is minimal (although better than Xero). For example, it doesn't provide any insights into available stock during order entry and does not object to invoices which send stock levels negative. It does have basic location tracking (which goes all the way through the financial accounts so it can be used to generate P&L per location). Transferring stock between locations probably requires manual adjustments. There is no assistance with automatic reordering.

Like Xero, it offers the ability to segment transactions. There are two dimensions, called "classes", and the functionality extends to budgeting. You can also budget per customer.

I think it is likely that this product will keep some Quickbooks users in the Quickbooks camp and if I were a small business already using QuickBooks, I would look first at QuickBooks online. The importance of cloud ecosystem (i.e. easy expansion via third party products) is the main weakness compared with Xero. Evaluating this means some vision for your company and the role of cloud-based IT.

Quickbooks Online feels less fully featured than Xero on the 'edges'. For example, it has no way to import sales orders from a CSV, requiring use of a third party solution. This is amazingly bad. It does let you import products via CSV, but the process is slow and fragile. Xero is in a completely different league with it comes to import/export, both in capabilities and robustness. At the time of writing, the product simply refuses to work in Chrome on my OS X ... and this has been the case for a few days. That is not a good look.

The traditional version of QuickBooks is well regarded by bookkeepers, who in my experience universally prefer it to MYOB AccountRight.

I find that Quickbooks Online is a very good product. It is arguably better supported than Xero, at least by the vendor. Substantially offsetting that advantage is that Xero has massively more market share in many places, particularly in Australia, NZ and the UK, so it's easy to find people who know Xero. Quickbooks has some very cheap plans if you trade off functionality. Inventory is a bit better than Xero but not adequate for anything but basic needs. Payroll is not as impressive as Xero. It has no fixed assets module. It doesn't have the ecosystem reach of Xero, but it is in a solid second place. That probably sums it up: a solid second place.

ReckonOne

Reckon is an Australian company. For more than 20 years, Reckon had the local licence for Quickbooks. Reckon didn't simply resell Quickbooks; it added all the Australian localisation that gave Quickbooks such a stellar reputation among small business accountants and bookkeepers. However, Intuit, the US owner of Quickbooks, term

Inventory: Perpetual vs Periodic

These products use average costing. There is no standard costing in the accounting sense. MYOB offers to use "standard costs" for POs and Bills, but this is just a supplier price list.

Saasu has Perpetual Inventory in all plans, but this product is being discontinued as Saasu refocuses on very small businesses. Quickbooks Online offers it in the "Plus" plan. In March 2015, Xero added perpetual inventory (a basic module; no API yet so it is not used by any third party apps). Quickbooks offers perpetual as well, but only in the highest plan. Perpetual is much better if you have stock. You can turn off inventory valuation and use the periodic method, if you prefer.

The inventory modules of Saasu, Xero and QuickBooks are basic: they don't allow backorders, for example, pricing options are very limited (although MYOB and QuickBooks are much better than Xero), there is no attempt at warehouse flows such as picking.

So you may need to integrate with an more package inventory management package. GrowthPath follows the main choices (Dear Inventory, Cin7, Unleashed and TradeGecko) and we are able to advise on an integrated solution for more sophisticated supply chain requirements.

Learn more about period vs perpetual inventory: You need to use Perpetual to understand what's going on in your business if you move stock.

Payroll Functionality of Xero, MYOB and QuickBooks

Payroll is a complicated part of business. While these systems support payroll, it doesn't remove the need to learn the ins and outs. Xero is the most helpful of the packages, even automating termination payments, and offering a basic self-help portal so employees can access payslips, submit timesheet and leave requests online. Xero also has the best expenses feature, at a small extra charge. Xero limits payroll numbers to 200: this a good indication of the limits of SME accounting software.

Xero payroll is best in class. MYOB's payroll is not very far behind. They are both very good payroll solutions for SMEs.

QuickBooks has good Australian localised payroll.

Customer and Sales Functionality

A customer in these system is either a person or an organisation. There is no concept of relationships between customers: you can't have a head office customer linked to shipping address customers.

Pricing is very primitive. Xero has one price per product, and that's it.

MYOB has a set of multiple prices lists which can be assigned to customers, and quantity-break pricing, so it's much better. You can also set mark-up pricing.

As with inventory, Xero has decided that if you have any complexity at all in your pricing and sales processes, find a proper front-end sales tool and integrate it.

POS

None of them offer POS natively. But there are good cloud options: Dear Inventory and CIn7 offer acceptable POS modules, and there are dedicated cloud POS systems such as Kounta, all of which integrate well with Xero, QuickBooks or MYOB. Note that with MYOB, you will have an much easier integration experience if you run it in "cloud mode", but the product is often too slow.

Shopify Integration

Shopify is the most common B2C solution for SMEs. There are integrations to Xero, MYOB and QBO. Note that with MYOB, you will have an much easier integration experience if you run it in "cloud mode", but the product is often too slow.

Bank Feeds

All these products have good bank-feed functionality for home-currency bank accounts, if you operate from one of the major markets for cloud accounting (USA, UK, NZ, Australia, and increasingly Singapore).

Xero is the most advanced, but what benefits you get from this depends on the bank you use. If you use NAB internet banking, Xero will soon offer a direct submission of payment requests, which is the first big efficiency gain in banking after the bank feed breakthough, which Xero pioneered. If you not in the one of the main markets, you may find that your bank does not even have a bank feed.

Automatic Intercompany Bookings

If you have transactions between businesses in the same corporate group, you probably consolidate them for financial reporting. Intercompany transactions need to be separated. Xero, QBO and MYOB AccountRight don't do that.

There are cloud tools that consolidate, and Xero has some other tools to help run reports over different charts of accounts. But there is no creation of automatic inter-entity loan entries.

Xero has some assistance: you can route a PO from one entity to appear as a SO in another entity, and the other way around. This removes some of the data entry.

The other approach is to run multiple businesses under one Xero or QBO package. Both Xero and QuickBooks have a concept similar to the sub-account of larger accounting systems, meaning you can create a "profit centre" and/or cost-centres to record bookings: see the next topic. This is a light-weight way of running the accounts of multiple entities in one system, but it will require careful attention to detail when booking, and you will need manual reporting to separate AR, AP and inventory. Accountants do not consider this a very attractive solution for multi-entity.

Multiple profit centres via sub-accounts

QuickBooks and Xero have options to link transactions to "categories"; (these are sub-accounts in traditional terminology), to identify divisions, profit centres or cost centres. Xero calls these "tracking categories" and QuickBooks has classes. They are not a bad solution although they do require coding in some detail when doing data entry. You could set up a three-dimensional chart, eg acct, profit centre and cost centre.

Historical Data

Data storage and processing of thousands of records are what computers should be good at, so it seems odd to focus on "historical data" ... except that MYOB, a big historical player in Australia, doesn't do history. Instead, it offers you "last year", "this year" and "next year". Data older than "last year" needs to be purged, and accessed by opening older versions of your company data.

None of the other systems discussed here have such a limit. Oddly, MYOB's only competitor in this space, AccountRight Live, still shares this legacy, probably because MYOB has not yet changed the very old database engine.

Importing historical transactional data into a new system is trickier than it seems, but it is possible (if you are not using MYOB). Options are to build a basic data warehouse and fill it with historical transactional data as well as a feed from the new system.

Analytics

Accounting reports are pretty useless for the decisions which help a business grow. The traditional reports are out of date and offer little to no insight into how you get sales, or what drives your profit. (The Profit and Loss and Balance Sheet are designed for outsiders like minority shareholders, banks and tax authorities). The only traditional report which I have much time for is the cash flow reconciliation (and in 2016 I say "hooray" to Xero, which now offers this report, called "Statement of Cashflows").

Analytics refers to software which lets you get closer to an up-to-date analysis of what you need to be focusing on. Regarding user experience, this is browser-based software that is heavily graphical and lets you "drill down" to see details, and "drill up" to keep a big-picture view. And so on. Getting good analytics is how small businesses become profitable bigger businesses, not just bigger businesses.

None of these systems includes much in the way of analytics, although Xero has a report writer. There are a few cloud packages which serve as decent "business intelligence" packages. I am a fan of analytics and dashboards, which are a crucial tool of GrowthPath's profit engineering approach. GrowthPath has recently decided to make Zoho Reports our preferred solution. For more advanced businesses, the enterprise-class tool Pentaho has an open-source solution.

We shouldn't get carried away by the technology, though. Eighty percent of a good analytics implementation is carefully designing a handful of key business drivers specific for your business in the context of its competitors and its market. The software aspect is 20%. You don't need 50 KPIs with very cool charts. You need less than ten or otherwise, you can't focus.

Business Control. Audit Trail and Lock Dates

Legacy MYOB is mostly used with no audit trail, because it is an optional setting, and nearly everyone turns it off. No longer: all of these cloud-based accounting apps are much better.

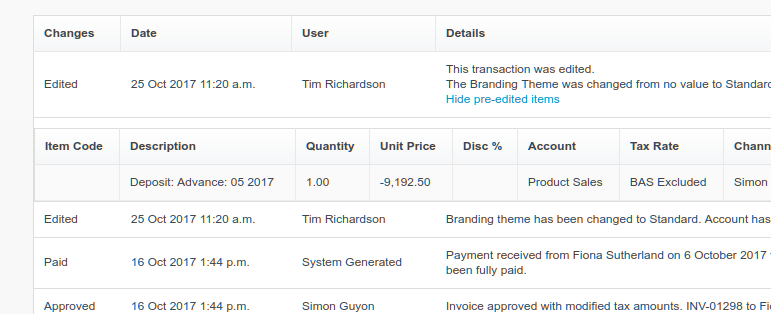

Below is a screen shot of the log of changes to an invoice Xero has recorded. This is a very useful audit trail. Xero has the best audit trail.

Other aspects of business control are enforcing separation of duties, which a system can do through its permissions module. The packages reviewed here have roughly equivalent roles, which I would describe as adequate for a small team.

Lock dates are another aspect of business control. Xero has a lock date for normal users and a special lock date for privileged users. This means normal users, and API users such as integrated ERP system can be blocked from entering transactions into last month, while the GL accountant or bookkeeper can still post month-end journals. This is an approximation of the feature of large systems which lets you lock AR & AP while keeping GL open.

Risks of moving to cloud accounting

When it comes to disadvantages of cloud-based accounting, there are three significant concerns: security, ownership of data and what to do if your internet connection goes down?

Security concerns are the most complicated of these three potential downsides.These points are covered here: cloud risks for SMEs.

When you terminate your cloud subscription?

Migrating accounting system is never much fun. If you cancel your subscription, it is usually to migrate to a new system. In a nutshell, cloud solutions are neither much worse or much easier for this migration.

If you want the view the data read-only, you could export from the old system both final reports and journal transactions saved in text files or spreadsheets.

This is clearly inferior to the traditional desktop software which has a perpetual licence: you can always open MYOB and view an old file. It would be nice if the cloud vendors provided permanent read access to terminated subscriptions. It is a common question.

Xero lets you reactivate an old account. Xero does not offer free read-only access, but without needing new transactions or payroll, the subscription can fall back to the lowest level of plan.

The Open API revolution of Cloud Accounting

The traditional model of business IT is all-under-one-roof monolithic IT systems (the king of this jungle is SAP R/3; MYOB is its little brother by concept). These systems were hard to integrate with other software, requiring specialised skills in proprietary languages and even proprietary databases. Once a business committed to a platform, it was largely locked in. After paying high upfront licence fees, they could look forward to expensive annual maintenance fees. Businesses relied for implementation on consultants who were narrow specialists in a particular proprietary solution (in fact, software specialists were themselves locked into particular solutions; moving to a new system was a traumatic career change). The period required to amortise the cost of the investment introduces a risk: what if business needs change during that time? Monolithic systems can become straight-jackets.

The monolithic approach risks a "Jack of all trades, master of none" approach. Why did they dominate business software? Before the rise of modern APIs, the cost of wiring together "best of breed " software was so high that monolithic systems ruled the earth. Now, they are an endangered species. Expensive to own, slow to innovate and hard to use, they are on the way out.

The API revolution can be starkly illustrated by the old and new approach to integrating software. A traditional software solution charges very high fees to buy the "developer licence" which only then provides the documentation and software allowing programmers to import and export data. Apart from the licence cost, APIs were poorly standardised and required a lot of love and attention. There was an entire breed of software called "middleware" which sprung up. Putting together systems required expensive specialised knowledge.

Cloud providers provide access to the API for free. Usually, you don't even need to register. They all support the same approach to sharing data and commands and allow developers to use open-source languages like Javascript and PHP. There are thousands of developers in Australia alone who can take two APIs they have never seen before, and get some basic interchange working later that day.

So the API revolution finally makes it possible for small businesses to combine best of breed software, something which not even large companies would attempt ten years ago.

Cloud-based Inventory Management (ERP)

A good example of integration potential for wholesalers is cloud ERP solutions. The three best options are Xero + Unleashed, Xero + Dear Inventory, and Xero + Cin7. Read more about Cloud ERP solutions

MYOB Account Right and 3rd party extensions

There are many third-party extensions for traditional MYOB: packages which add features. They are installed locally, next to a MYOB installation.

Today, MYOB has three technical approaches in the market: (a) MYOB "Classic" (e.g AccountRight Premier, Enterprise), (b) the hybrid AR Live and (c) the pure-cloud MYOB Essentials. The API is different in each case, so vendors of extensions will have different levels of support across these three options. That is, if you rely on an extension in classic MYOB, don't expect it will be available on the other two platforms. MYOB Classic requires access through a slow and not very robust ODBC connection which connects locally. AR Live vendors can offer API-based cloud support if you use this product in cloud mode (which even MYOB says is slow). If you use it locally, the extension vendor must also support local installations. Even in local mode, AR Live no longer supports the ODBC connection, so classic extensions don't work.

It's a complicated picture which will make things difficult for vendors. MYOB Essentials is a real cloud product and is included as such in this page. It has a different API to AR Live.

Profit Engineering ... the business case for changing systems is more than simple efficiency

At GrowthPath, helping clients choose better systems is a means to an end, and that end is profitable growth. When you're ready to start using new insights to grow your business, you may be interested in our Profit Engineering approach.

Some articles worth looking at are:

- Contribution Margin vs Gross Margin, a simple, easy improvement to reporting for more profitable decisions

- Choosing an inventory method: Perpetual or Periodic. The Perpetual method is vastly superior and well worth the extra effort

- Cash vs Profit: the uses and abuses of these two performance measurements

- Measuring your procurement effectiveness with the Purchase Efficiency KPI

inated the agreement and Reckon needed to transition to its own products. ReckonOne is that independent product.

There's an entry level pure cloud package, ReckonOne (with prices starting at $5 a month), and a "hosted" version of a traditional desktop package (which is still very similar to QuickBooks). I haave not paid much attention to ReckonOne. I have not come across a GrowthPath client or potential client using it, and it doesn't appear very often as a product supported in the growing cloud ecosystem. I have no experience with ReckonOne and I haven't made the time to review it, so until I do, I advise you to look elsewhere for information on this product.

In November 2017, the most profitable parts of Reckon were acquired by MYOB (products serving large accounting firms). Reckon announced the proceeds will be used to pay down debt and as a special dividend (so not R&D). The CEO announced that Reckon would focus on micro-business clients (sole-traders). Given this development, GrowthPath feels that Reckon products are not really a very sound approach for larger SMEs to consider.

And don't forget cloud productivity solutions

Such as Google Apps, Office 365, Infusionsoft ...

In their own right, cloud-based accounting systems offer a lot of benefits. You can magnify it by moving to cloud-based collaboration tools.

The main players are Google Apps for Business and Office 365. This is not the place for a comparison, but I prefer Google's solution since it offers a clean break from desktop software, is much easier to manage, works well from Chromebooks (which are a Very Good Thing) and it's cheaper to boot.

Microsoft has a cloud offer as well (Office 365), reluctantly at first but now that it sees the writing on the wall, it's taking it more seriously, although the total offer still appears designed to be anchored to desktop users.

I have no doubt that Xero, Quickbooks Online and all serious players will support both Google and Microsoft, plus Dropbox, Box and Slack won't be far away.

Xero at this stage is clearly leading when it comes to integrations. It has offered Google Apps integration for perhaps two years at least, and now has some Office 365 support and Box. There is a clear pattern that Xero is always ahead of its competitors when it comes to cloud integration. Generally speaking, the first movers (Xero and Google) have kept their advantage via a fearsome pace of new features.

Congratulations on working your way through this!

Google analytics tells me that many visitors spend ten minutes or more on this page, which is a lot for a web page.

If you're one of them, you may also be interested in using your accounting data to grow the business, not just fill in the BAS.

These articles may be interesting:

- Contribution Margin vs Gross Margin, a simple, easy improvement to reporting for more profitable decisions

- Choosing an inventory method: Perpetual or Periodic. The Perpetual method is vastly superior and well worth the extra effort

- Cash vs Profit: the uses and abuses of these two performance measurements

- Measuring your procurement effectiveness with the Purchase Efficiency KPI

GrowthPath has a fast process to help you select and setup the correct system. Fees start from $199 for new businesses. We do custom investigations for firms looking to save $15K to $30K in avoided annual maintenance fees linked to legacy ERP systems.